Bandits in auctions (& more)

Apparaît également dans la collection : CEMRACS - Summer school: Numerical methods for stochastic models: control, uncertainty quantification, mean-field / CEMRACS - École d'été : Méthodes numériques pour équations stochastiques : contrôle, incertitude, champ moyen

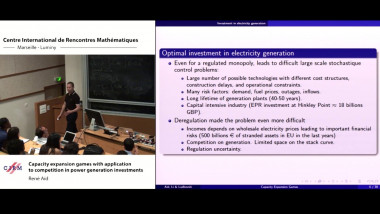

In this talk, I will introduce the classical theory of multi-armed bandits, a field at the junction of statistics, optimization, game theory and machine learning, discuss the possible applications, and highlights the new perspectives and open questions that they propose We consider competitive capacity investment for a duopoly of two distinct producers. The producers are exposed to stochastically fluctuating costs and interact through aggregate supply. Capacity expansion is irreversible and modeled in terms of timing strategies characterized through threshold rules. Because the impact of changing costs on the producers is asymmetric, we are led to a nonzero-sum timing game describing the transitions among the discrete investment stages. Working in a continuous-time diffusion framework, we characterize and analyze the resulting Nash equilibrium and game values. Our analysis quantifies the dynamic competition effects and yields insight into dynamic preemption and over-investment in a general asymmetric setting. A case-study considering the impact of fluctuating emission costs on power producers investing in nuclear and coal-fired plants is also presented.