Appears in collection : Jean-Morlet Chair 2020 - Research School: Quasi-Monte Carlo Methods and Applications / Chaire Jean-Morlet 2020 - Ecole: Méthode de quasi-Monte-Carlo et applications

The recent papers Gajek-Kucinsky (2017), Avram-Goreac-LiWu (2020) investigated the control problem of optimizing dividends when limiting capital injections by bankruptcy is taken into consideration. The first paper works under the spectrally negative Levy model; the second works under the Cramer-Lundberg model with exponential jumps, where the results are considerably more explicit.

The first talk extends, exploiting the W-Z scale functions, results of Gajek-Kucinsky (2017) to the case when a final penalty is taken into consideration as well. This requires the introduction of new scale and Gerber-Shiu functions.

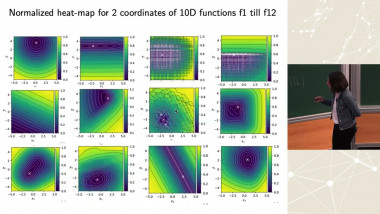

The second talk illustrates the fact that quite reasonable approximations of the general problem may be obtained using the exponential particular case studied in Avram-Goreac-LiWu (2020). We start by experimenting with de Vylder type approximations for the scale function $W_q(x)$; this amounts essentially to replacing our process by one with exponential jumps and cleverly crafted parameters based on the first three moments of the claims. We show that very good approximations may be obtained for two fundamental objects of interest: the growth exponent $\Phi_q$ of the scale function $W_q(x)$, and the (last) global minimum of $W_q'(x)$, which is fundamental in the de Finetti barrier problem. Turning then to the dividends and limited capital injections problem, we show that a new exponential approximation specific to this problem achieves very good results: it consists in plugging into the objective function for exponential claims the exact "non-exponential ingredients" (scale functions and, survival and mean functions) of our non-exponential examples.