Appears in collection : CEMRACS - Summer school: Numerical methods for stochastic models: control, uncertainty quantification, mean-field / CEMRACS - École d'été : Méthodes numériques pour équations stochastiques : contrôle, incertitude, champ moyen

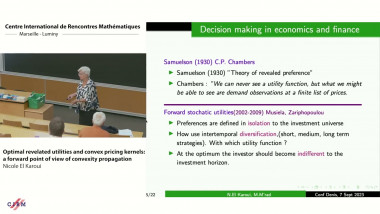

Industrial strategic decisions have evolved tremendously in the last decades towards a higher degree of quantitative analysis. Such decisions require taking into account a large number of uncertain variables and volatile scenarios, much like financial market investments. Furthermore, they can be evaluated by comparing to portfolios of investments in financial assets such as in stocks, derivatives and commodity futures. This revolution led to the development of a new field of managerial science known as Real Options.

The use of Real Option techniques incorporates also the value of flexibility and gives a broader view of many business decisions that brings in techniques from quantitative finance and risk management. Such techniques are now part of the decision making process of many corporations and require a substantial amount of mathematical background. Yet, there has been substantial debate concerning the use of risk neutral pricing and hedging arguments to the context of project evaluation. We discuss some alternatives to risk neutral pricing that could be suitable to evaluation of projects in a realistic context with special attention to projects dependent on commodities and non-hedgeable uncertainties. More precisely, we make use of a variant of the hedged Monte-Carlo method of Potters, Bouchaud and Sestovic to tackle strategic decisions. Furthermore, we extend this to different investor risk profiles. This is joint work with Edgardo Brigatti, Felipe Macias, and Max O. de Souza.

If time allows we shall also discuss the situation when the historical data for the project evaluation is very limited and we can make use of certain symmetries of the problem to perform (with good estimates) a nonintrusive stratified resampling of the data. This is joint work with E. Gobet and G. Liu.