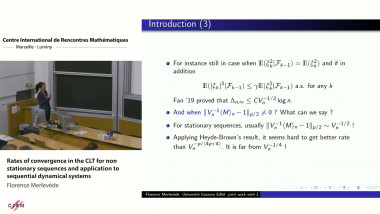

Rates of convergence in the CLT for non stationary sequences and application to sequential dynamical systems

By Florence Merlevède

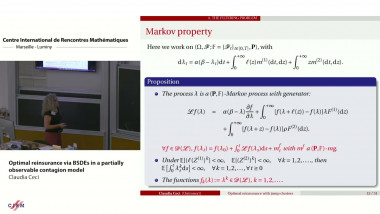

Optimal reinsurance via BSDEs in a partially observable contagion model

By Claudia Ceci

Appears in collection : Innovative Research in Mathematical Finance / Recherche innovante en mathématiques financières

For several decades, the no-arbitrage (NA) condition and the martingale measures have played a major role in the financial asset's pricing theory. Here, we propose a new approach based on convex duality instead of martingale measures duality: our prices will be expressed using Fenchel conjugate and biconjugate. This naturally leads to a weak condition of absence of arbitrage opportunity, called Absence of Immediate Profit (AIP), which asserts that the price of the zero claim should be zero. We study the link between (AIP), (NA) and the no-free lunch condition. We show in a one step model that, under (AIP), the super-hedging cost is just the payoff's concave envelop and that (AIP) is equivalent to the non-negativity of the super-hedging prices of some call option. In the multiple-period case, for a particular, but still general setup, we propose a recursive scheme for the computation of a the super-hedging cost of a convex option. We also give some numerical illustrations.