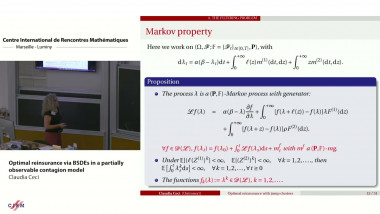

Dependent stopping times

Disasters often occur with the confluence of two or more events. In Credit Risk it can be the default of two globally systemically important banks at the same time. In Civil Engineering it can be the collapse of a building, such as the recent Champlain Towers in Miami Beach. In Aeronautics a recent example is the carshes of the Boeing 737 Max 8 airplanes. What is common to these disasters is the simultaneous failures of multiple crucial factors. We resent mathematical models of stopping times, following the traditional so-called Cox constructions, where simultaneous, or nearly simultaneous stopping times occur. This builds on the work of Ying Jiao, Tomas Bielecki, Delia Coculescu, and others. My talk is based on joint work with Alejandra Quintos.