CVaR hedging using quantization based stochastic approximation algorithm

By Gilles Pagès

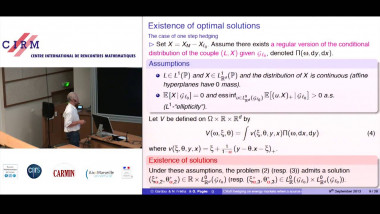

We investigate a method based on risk minimization to hedge observable but non-tradable source of risk on financial or energy markets. The optimal portfolio strategy is obtained by minimizing dynamically the Conditional Value-at-Risk (CVaR) using three main tools: a stochastic approximation algorithm, optimal quantization and variance reduction techniques (importance sampling (IS) and linear control variable (LCV)) as the quantities of interest are naturally related to rare events. We illustrate our approach by considering several portfolios in connection with energy markets.

Keywords : VaR, CVaR, Stochastic Approximation, Robbins-Monro algorithm, Quantification