Appears in collection : Advances in stochastic analysis for risk modeling / Analyse stochastique pour la modélisation des risques

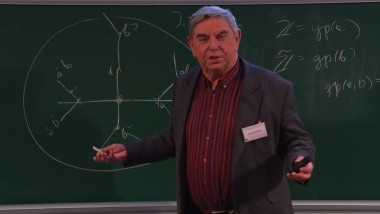

We study a financial market in which some assets, with prices adapted w.r.t. a reference filtration F are traded. In this presentation, we shall restrict our attention to the case where F is generated by a Brownian motion. One then assumes that an agent has some extra information, and may use strategies adapted to a larger filtration G. This extra information is modeled by the knowledge of some random time $\tau$, when this time occurs. We restrict our study to a progressive enlargement setting, and we pay particular attention to honest times. Our goal is to detect if the knowledge of $\tau$ allows for some arbitrage (classical arbitrages and arbitrages of the first kind), i.e., if using G-adapted strategies, one can make profit. The results presented here are based on two joint papers with Aksamit, Choulli and Deng, in which the authors study No Unbounded Profit with Bounded Risk (NUPBR) in a general filtration F and the case of classical arbitrages in the case of honest times, density framework and immersion setting. We shall also study the information drift and the growth of an optimal portfolio resulting from that model (forthcoming work with T. Schmidt).